Trump Tariffs 2025: What It Means for Global Trade and Maritime Logistics

Ayana CEO

After graduating from the Faculty of Literature at Kobe University, she joined Rakuten Inc. to learn the fundamentals of e-commerce. Later, she switched to a foreign manufacturing company and faced challenges from the manufacturer's perspective. While studying business strategy in an evening MBA program, she developed an interest in marketing for luxury brands rather than FMCG (Fast-Moving Consumer Goods). This led her to study abroad at ESSEC Business School in France. Upon returning to her home country, she worked as an EC Manager for a foreign cosmetics manufacturer, served as a CMO for a startup, and eventually founded MonCargo.

April 2025: President Trump Unveils a New Tariff Policy

What’s happening on the ground in maritime shipping and global logistics?

In this article, MonCargo explains the intent and context of the new tariffs, historical lessons, and the real-world impact — all from the perspective of frontline logistics professionals.

In This Article:

- What is Trump’s new tariff policy and why was it implemented?

- Historical context and economic consequences of past tariff regimes

- Impact on maritime shipping and practical insights for the industry

What Just Happened: The Trump Tariffs of April 2025

On April 2, 2025, President Trump declared a “Day of Liberation” and announced a sweeping tariff policy: a 10% base tariff on all imports and country-specific “Reciprocal Tariffs” targeting nations accused of unfair trade practices.

These measures come into effect quickly:

Effective Dates:

- Base Tariff: April 5 at 12:01 a.m. (EDT)

- Reciprocal Tariffs: April 9 at 12:01 a.m. (EDT)

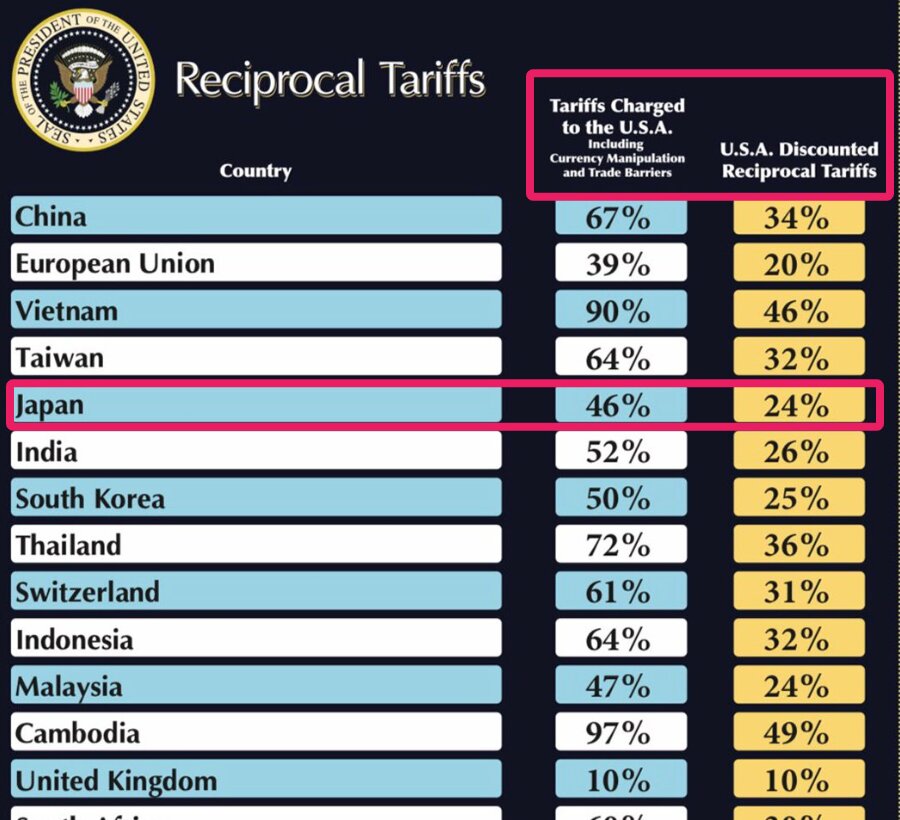

Sample Reciprocal Tariff Rates by Country:

- Japan: 24%

- China: 34%

- EU: 20%

- UK: 10%

- Turkey: 10%

- India: 26%

- South Korea: 25%

- Israel: 17%

- Taiwan: 32%

- Vietnam: 46%

Source: The White House, Annex I: U.S.A. Discounted Reciprocal Tariffs, April 2025 PDF

This chart, posted by the official White House account on X, shows two key numbers for each country:

Source:WhiteHouse Official X: Reciprocal Tariffs April,2025

Left Column Title:

Tariffs Charged to the U.S.A., Including Currency Manipulation and Trade Barriers

Right Column Title: U.S.A. Discounted Reciprocal Tariffs

The idea behind these reciprocal tariffs is based on the premise that the U.S. faces hidden costs — such as non-tariff barriers like strict regulations, licensing systems, or insufficient IP protections — which effectively act as trade restrictions. According to the Trump administration, these justify the “discounted” tariffs the U.S. is now applying.

For example, in the case of Japan, the administration claims the U.S. faces an effective 46% burden (tariff + trade barriers), and is now responding with a 24% tariff.

Why Did the Trump Administration Implement These Tariffs?

The White House Fact Sheet outlines the reasoning:

“Pursuing Reciprocity to Rebuild the Economy and Restore National and Economic Security.”

From this, we can summarize three key objectives:

1. Fixing the Trade Deficit

The U.S. has run a chronic goods trade deficit (over $1.2 trillion in 2024). Tariffs are being positioned as a national emergency tool to reverse deindustrialization, job loss, and weakened defense manufacturing.

2. Countering Unfair Trade Practices

Countries impose higher tariffs and hidden barriers on U.S. goods. Trump is demanding reciprocity — “Treat us like we treat you” — by introducing Reciprocal Tariffs to level the playing field.

3. National & Economic Security

Heavy foreign dependency threatens supply chains and military stockpiles. By encouraging reshoring and strengthening “Made in America,” the administration aims to reclaim U.S. sovereignty.

What Are “Reciprocal Tariffs”?

This concept isn’t just about imposing tariffs — it's about justifying them as a fair response to other countries’ trade barriers.

According to the White house Fact Sheet:

“He is the first President in modern history to stand strong for hardworking Americans by asking other countries to follow the golden rule on trade: Treat us like we treat you.”

The administration claims that even if official tariffs are low, many countries impose non-tariff barriers, such as:

- Stringent inspections for foreign goods

- Licensing requirements that restrict entry

- Weak IP enforcement

These are factored into their “Reciprocal Tariff” formula — though the methodology for calculating these burden estimates (like Japan’s 46%) is not disclosed.

For a deeper dive, see the 2025 USTR National Trade Estimate Report PDF.

For example, in Japan, stringent regulations on pesticide residues and food additives make it difficult for foreign companies to enter the market. These invisible obstacles to imports are counted by the Trump administration as part of Japan’s total trade burden on the U.S.

According to their claims, when these non-tariff barriers are factored in, it’s as if Japan is effectively imposing a 46% tariff on American goods. As a response, the U.S. has now imposed a "reciprocal" tariff of 24%.

However, the basis for this 46% figure is entirely unclear. There is no published methodology, no breakdown of calculations, and no economic transparency to support this number. From my point of view, it feels more like a rhetorical tool or political pitch than a rigorously justified trade measure.

Let’s pause here and shift focus to a key question:

What historical lessons can we draw from past tariff policies — and what might Trump’s new tariffs mean for global trade today?

Learning from History: What Can We Expect from Trump’s 2025 Tariffs?

To understand the future impact of Trump’s 2025 tariff policy, we must look at how past tariffs have played out in the real world. Here are two major historical examples worth examining:

1. 1930 – The Smoot-Hawley Tariff Act

Passed shortly after the 1929 stock market crash, the Smoot–Hawley Tariff Act was meant to protect American farmers and industries. It raised tariffs on over 20,000 imported goods.

Despite objections from economists, President Hoover signed it into law in June 1930. The impact was devastating:

- U.S. average tariff rate jumped from 33% to 40%

- Other countries retaliated with their own tariffs

- Global trade volume fell by 66% between 1930 and 1933

Germany was particularly hard-hit. Still recovering from World War I reparations, it relied on exports to fund its obligations. The loss of export markets deepened its economic crisis and contributed to the rise of Nazism in 1933.

This episode shows that protectionist policies can backfire, triggering global retaliation and long-term economic damage — even if they seem to protect domestic industries in the short term.

2.2018–2019: The U.S.-China Trade War (Trump’s First Term)

In 2018, President Trump launched a large-scale tariff campaign against China under the banner of “America First,” aiming to reduce the trade deficit and combat intellectual property theft.

China responded with retaliatory tariffs, and a tariff standoff ensued.

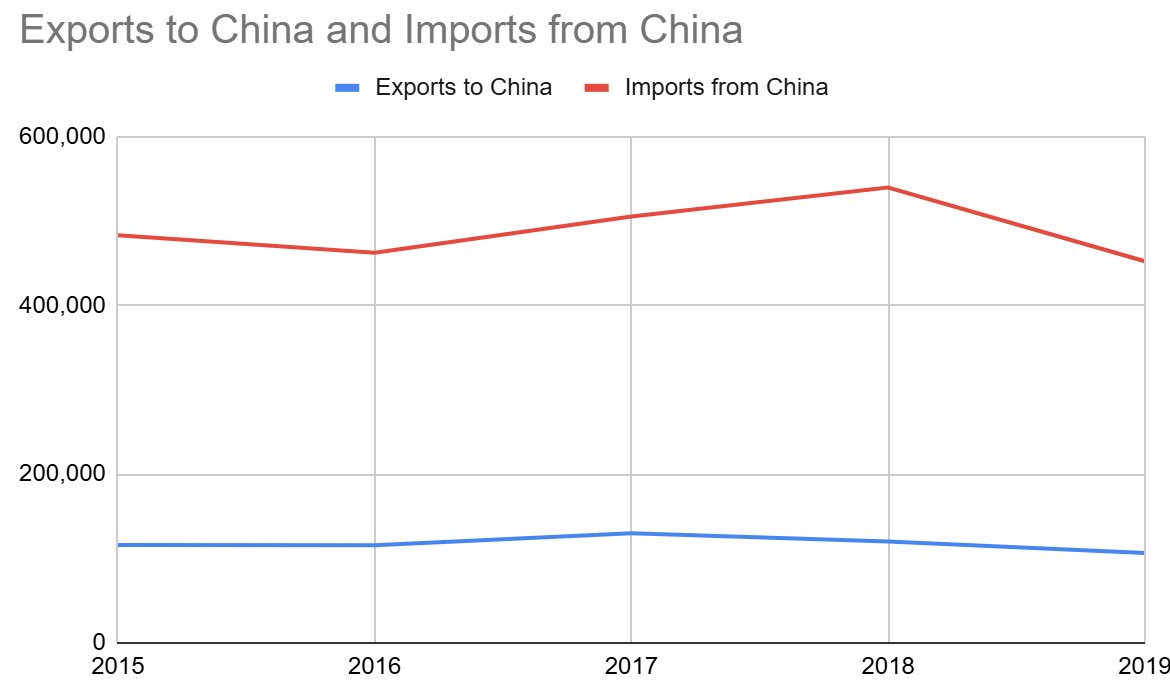

By 2019, the numbers told the story:

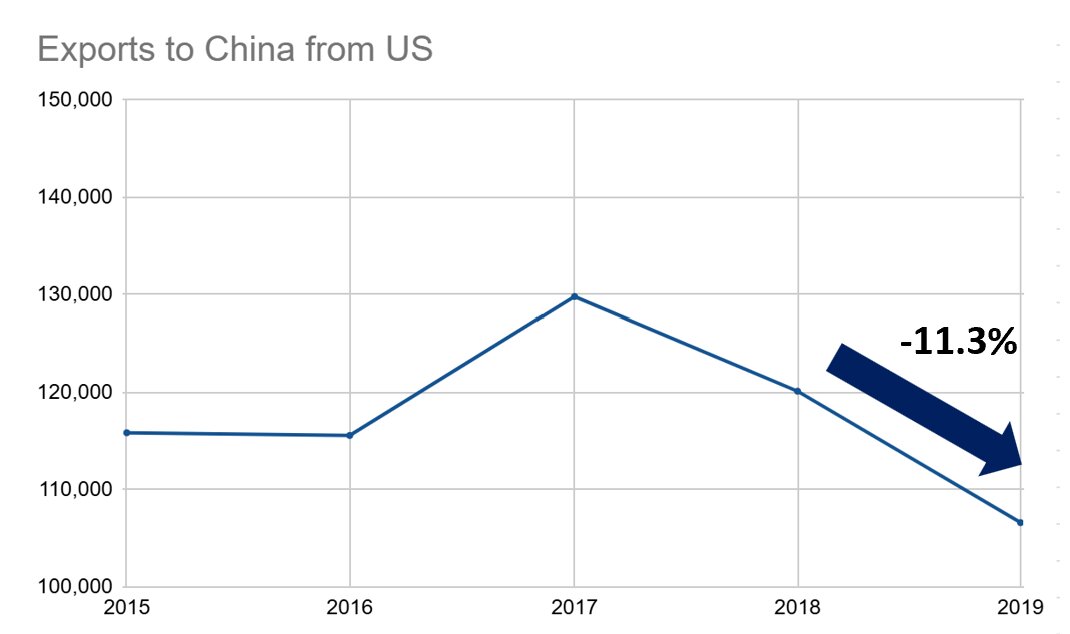

- U.S. exports to China fell by $13.5 billion (-11.3%) to $106.6 billion

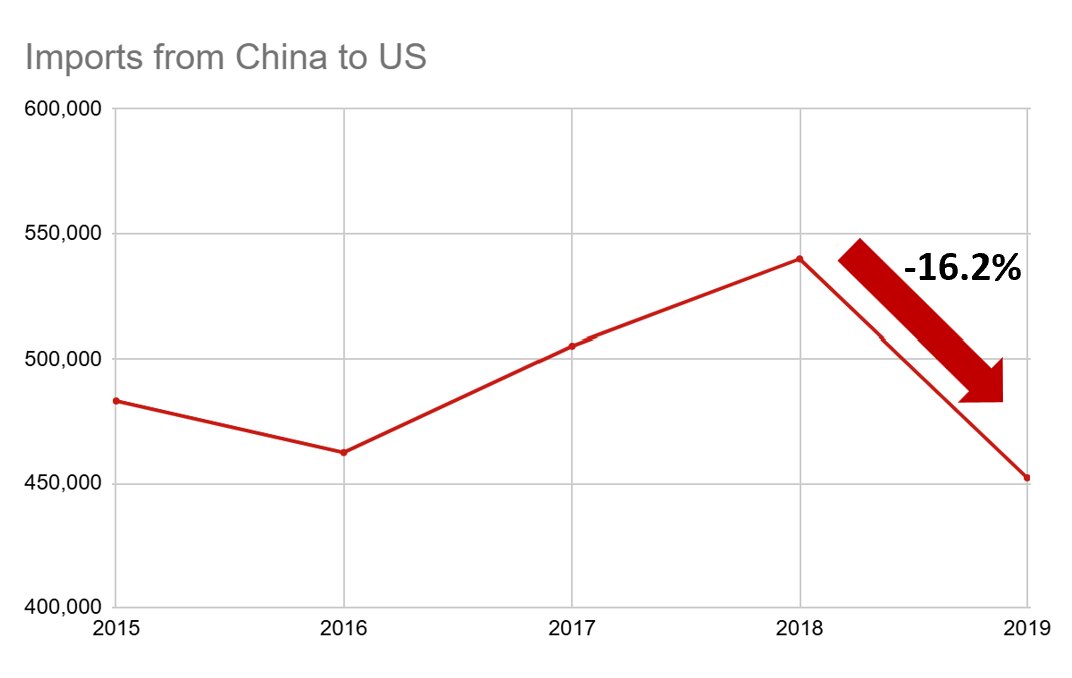

- U.S. imports from China fell by $87.4 billion (-16.2%) to $452.2 billion

U.S. Exports to China (2015–2019) (million dollars):

U.S. Imports from China (2015–2019) (million dollars):

U.S.-China Trade Balance (2015–2019) (million dollars):

This trade war also disrupted container shipping, altered shipping routes, and forced companies to rethink their global supply chains. Although the “Phase One” deal in 2020 temporarily eased tensions, Trump’s new 2025 reciprocal tariffs are likely to reignite trade friction.

Both the Smoot-Hawley Act and the 2018–2019 U.S.-China trade war were launched under the banner of protecting national industries. But both had profound negative consequences for the global economy.

A Fork in the Road: Will the World Embrace Protectionism Again?

History teaches us that short-term protectionism often leads to long-term economic instability.

Now, with Trump’s new reciprocal tariffs in place, the world faces a critical choice:

Will we return to economic nationalism, or find a way to rebuild a new era of fair and open global trade?

As companies, we too must pay close attention and adapt to the shifting tides of international trade policy.

MonCargo’s Perspective: Real-World Impact on Maritime Logistics

Major policy shifts like these tariffs inevitably ripple through the world of maritime transport.

According to an interview by Reuters with NYK Line President Mr. Soga, there was a noticeable uptick in exports from China to the U.S. right after Trump’s election, especially for consumer goods. Nikkei also reported that container shipments from Asia to the US in December 2024 were the highest ever for the same month, which is believed to have increased exports in the rush.

However, because the April 2 announcement was followed by rapid implementation (April 5 for the base tariff, and April 9 for reciprocal tariffs), there was very little time for shippers to react with last-minute export pushes.

Looking ahead, we cannot rule out the possibility of a decline in bookings bound for North America. However, as of this week, based on shipping data registered in MonCargo, we have not observed a significant drop in export volumes to the U.S.

Rebuilding supply chains takes time. In the short term, we may not see dramatic changes — but logistics professionals should remain vigilant.

What’s more immediate are issues like:

- Route changes and port reassignments

- Delays in vessel schedules

- Day-to-day operational disruptions

These can occur without warning. That’s why real-time visibility and rapid communication within your team are more important than ever.

MonCargo Helps You Track Vessel Movements and Container Status

In today’s volatile trade environment, early detection and fast internal coordination are the keys to avoiding chaos.

As tariffs rise and geopolitical risks grow, companies must make quicker, better-informed decisions.

That’s where MonCargo comes in:

- Vessel tracking and ETA monitoring

- Automatic alerts for delays and port changes

- Easy-to-use dashboard and shareable tracking links for teams

Let's start your free 30-day trial today from here

Keep your supply chain transparent — even in turbulent times.

References (As of April 6, 2025)

The following primary documents were used to organise and explain the information from MonCargo's own perspective:

- White House Executive Order: Regulating Imports with a Reciprocal Tariff

- White House Fact Sheet: Declaring National Emergency to Restore U.S. Economic Security

- Reuters: Summary of Trump's New Tariff Policy

- Reuters: Economic Impact of the New Tariffs

- Reuters: Market Reaction – Yuan and Chinese Stocks

- Reuters: Japan's Rice Tariff Policy

- Reuters Interview: Concerns About Trump Tariffs’ Impact on Shipping

- USTR: 2025 National Trade Estimate Report on Foreign Trade Barriers

- USTR PDF: 2025 Report on Foreign Trade Barriers

- USITC: Trade Statistics and Analysis – China

- METI: 2024 White Paper on International Trade (PDF, in Japanese)

- Nikkei: Container traffic to the US, highest in Dec.

- JETRO: Structural Shifts in Trade from U.S.-China Relations (in Japanese)

- Japan Foreign Trade Council: Analysis on U.S. Tariff Policy (2019, in Japanese)

- Wikipedia: Smoot–Hawley Tariff Act

- World History Window: The Smoot–Hawley Act (in Japanese)

- World History Window: Protectionist Tariff Policies (in Japanese)

- World History Window: The Great Depression (in Japanese)

- World History Window: German Reparations Crisis (in Japanese)