History of ONE: Reasons for the Integration of Japan's Top Three Shipping Companies' Container Shipping Business

Ayana CEO

After graduating from the Faculty of Literature at Kobe University, she joined Rakuten Inc. to learn the fundamentals of e-commerce. Later, she switched to a foreign manufacturing company and faced challenges from the manufacturer's perspective. While studying business strategy in an evening MBA program, she developed an interest in marketing for luxury brands rather than FMCG (Fast-Moving Consumer Goods). This led her to study abroad at ESSEC Business School in France. Upon returning to her home country, she worked as an EC Manager for a foreign cosmetics manufacturer, served as a CMO for a startup, and eventually founded MonCargo.

In this post, we will describe the history of ONE.

What is ONE?

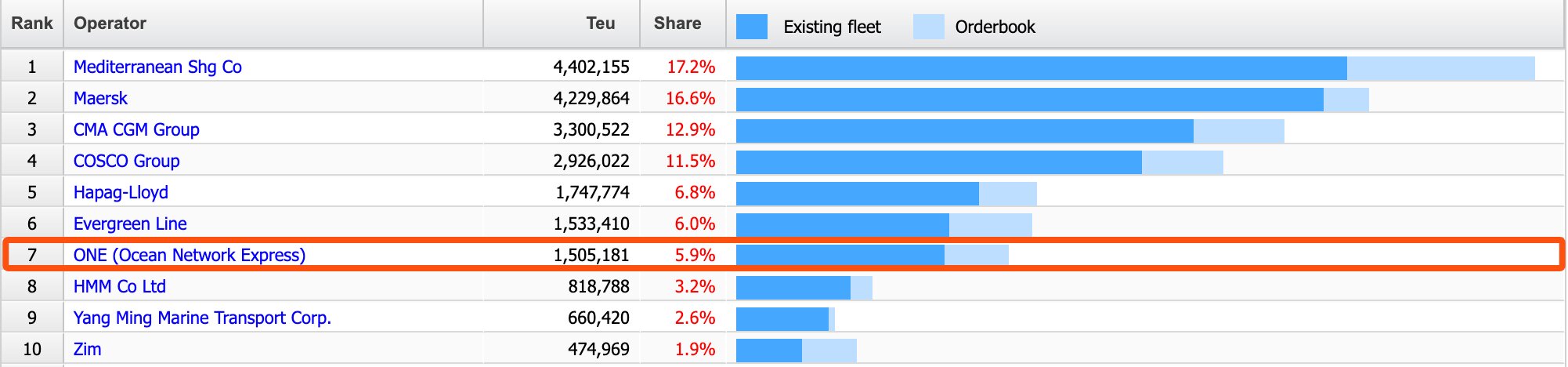

ONE, which stands for Ocean Network Express (Japan) Ltd., is a Japanese shipping company established by three Japanese shipping companies, NYK Line, Mitsui O.S.K. Lines, and Kawasaki Kisen Kaisha, Ltd. through the merger of their container liner business divisions. At present, the company ranks 7th in the world in terms of the scale of its container shipping operations*. (Updated rank is 6th on 2023/10/16)

※Alphaliner|Alphaliner TOP 100 / 07 Jun 2022時点

History of ONE - Shipping Market Background in the 2000s

Ocean Network Express Pte. Ltd. (ONE), Japan's only ocean liner shipping company, was formed through the merger of three Japanese container shipping companies.

Why did three companies that had been rivals join forces? According to the official website, the company explains that competition in the container liner business has intensified globally since the collapse of Lehman Brothers, and with the introduction of super-large container vessels capable of carrying approximately 20,000 containers, it was necessary to ensure competitiveness through economies of scale. To learn more about this part of the story, three prerequisites are required, which we will briefly explain.

1) Difference between Liner and Bulk Shipping

Shipping methods can be broadly divided into liner and tramp shipping.

- Liner : A method of transportation that takes place on a fixed route with a fixed port of call and schedule.

- Tramper: A method of transportation in which ports of call and schedules are determined according to customer demand and cargo, without setting a specific route.

Container ships are representative of this type of liner shipping. Because they operate on a fixed route and schedule, they can be compared to a route bus. Just as a bus company earns more money when the bus is full of passengers, a container ship earns more money the more cargo it carries. In order to make a profit in the container shipping business, it is necessary to improve the loading rate, and it has been difficult for all companies to make a profit in the container shipping business.

2) Container Cargo Volume in the 2000s

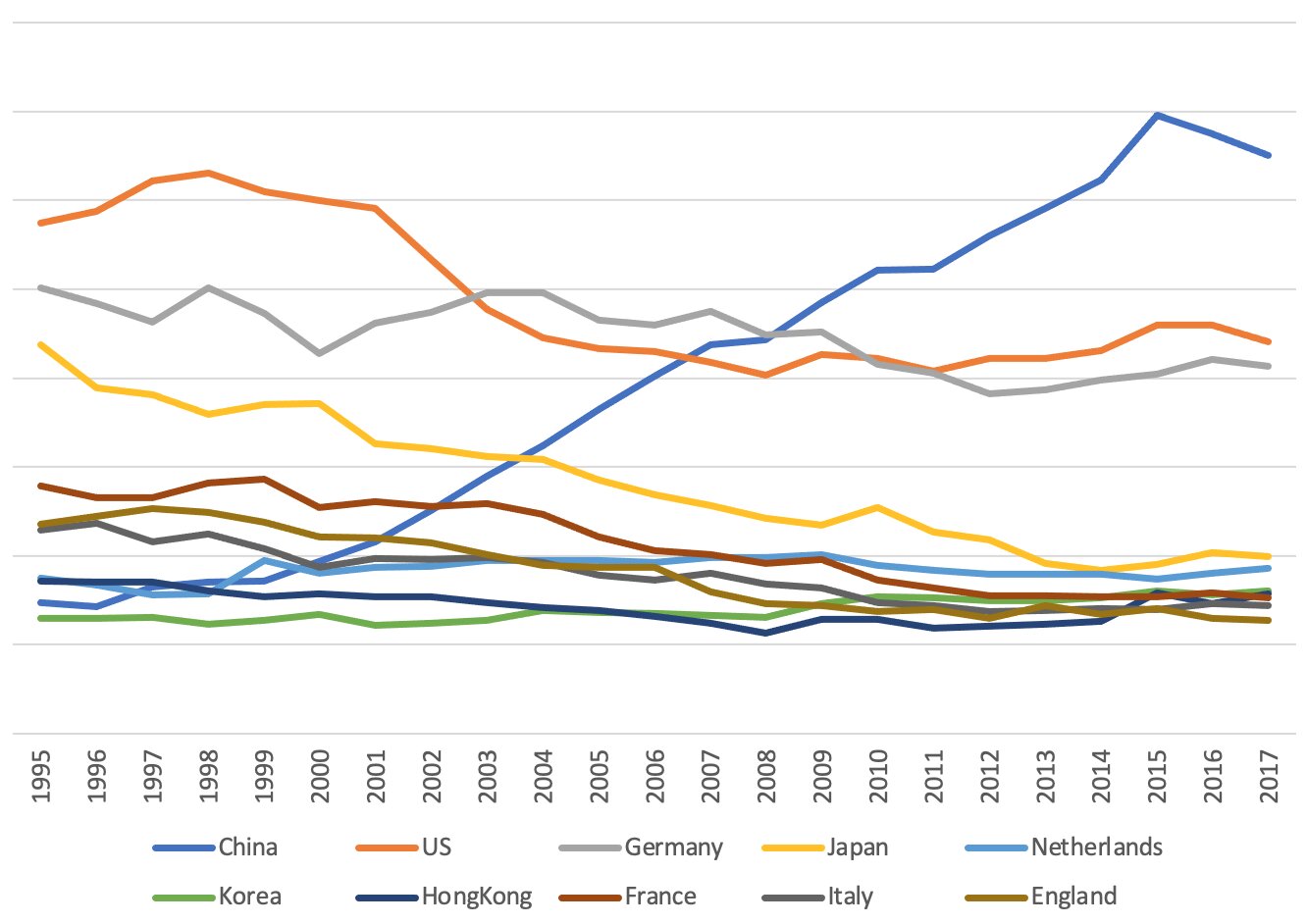

Let us look at the container situation in the 2000s. The following data is from Japan's Ministry of Economy, Trade and Industry (METI). Since China joined the WTO in 2001, its export volume has increased, and in about 15 years it has grown to become the world's largest trading power along with the United States. In other words, we can say that China's first containerized cargoes increased rapidly.

▼ Percentage of world exports by major countries

Source:Ministry of Economy, Trade and Industry data prepared by the author

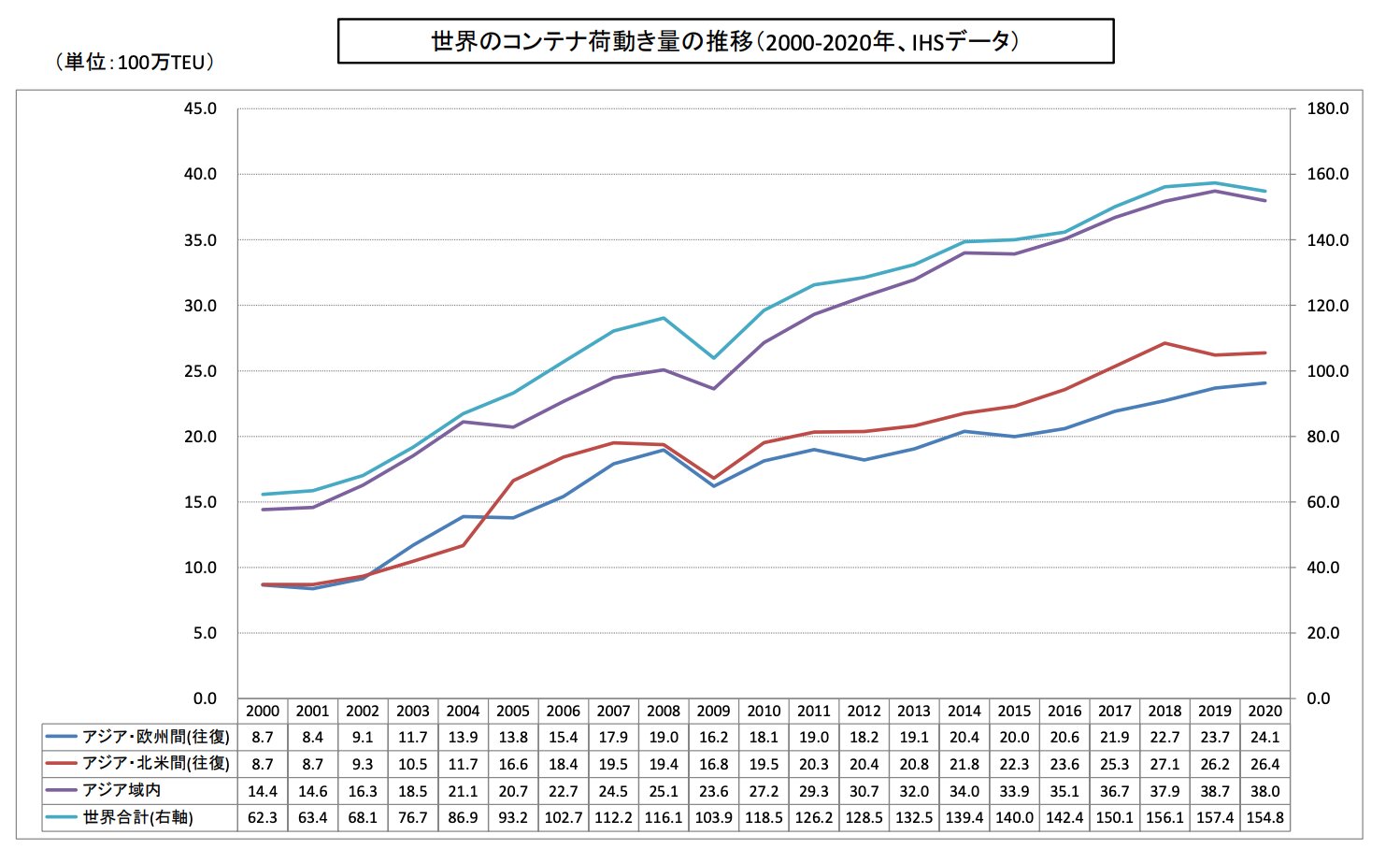

The figure below shows Japan's global containerized cargo volume, which has also been growing steadily since the 2000s. The increase in demand and the global economic boom led to an increase in shipping rates and orders for new vessels. After the rush of ship orders, the Lehman Brothers collapse occurred in 2008. The figure below also shows a decline from 2008 to 2009, which is due to the global recession caused by the Lehman Shock.

▼Global Container Cargo Volume

Source:Japan Maritime Center

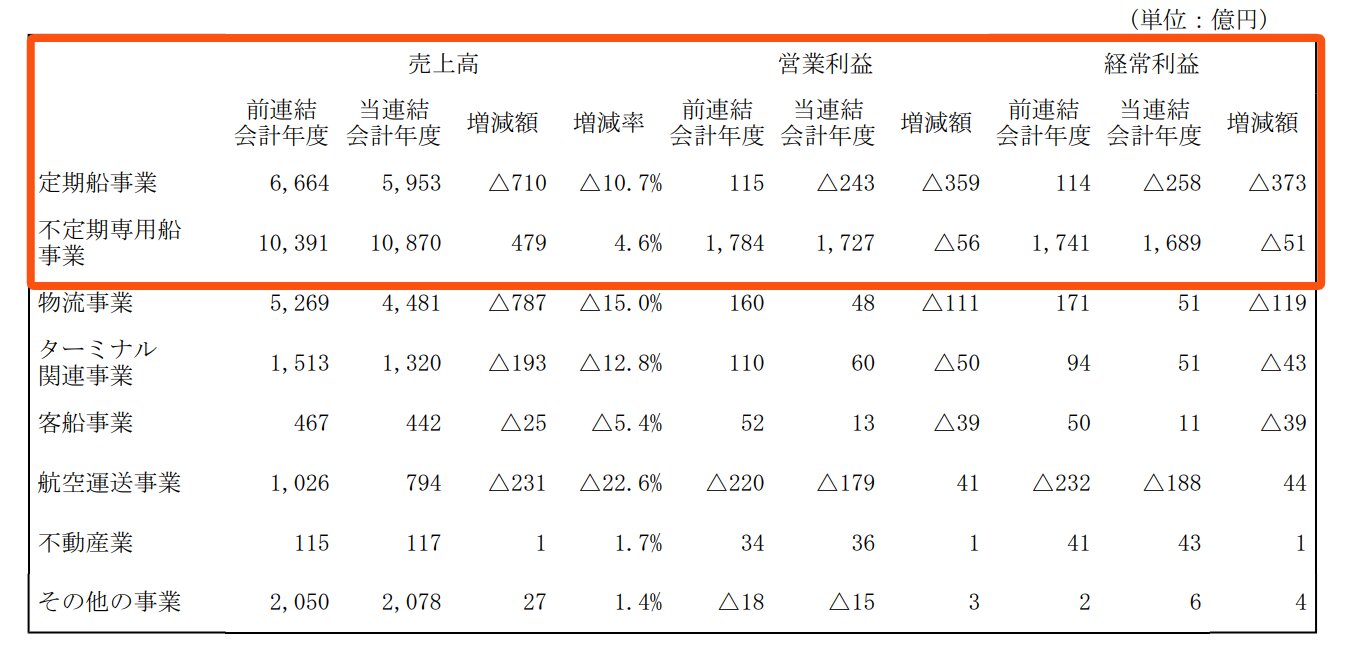

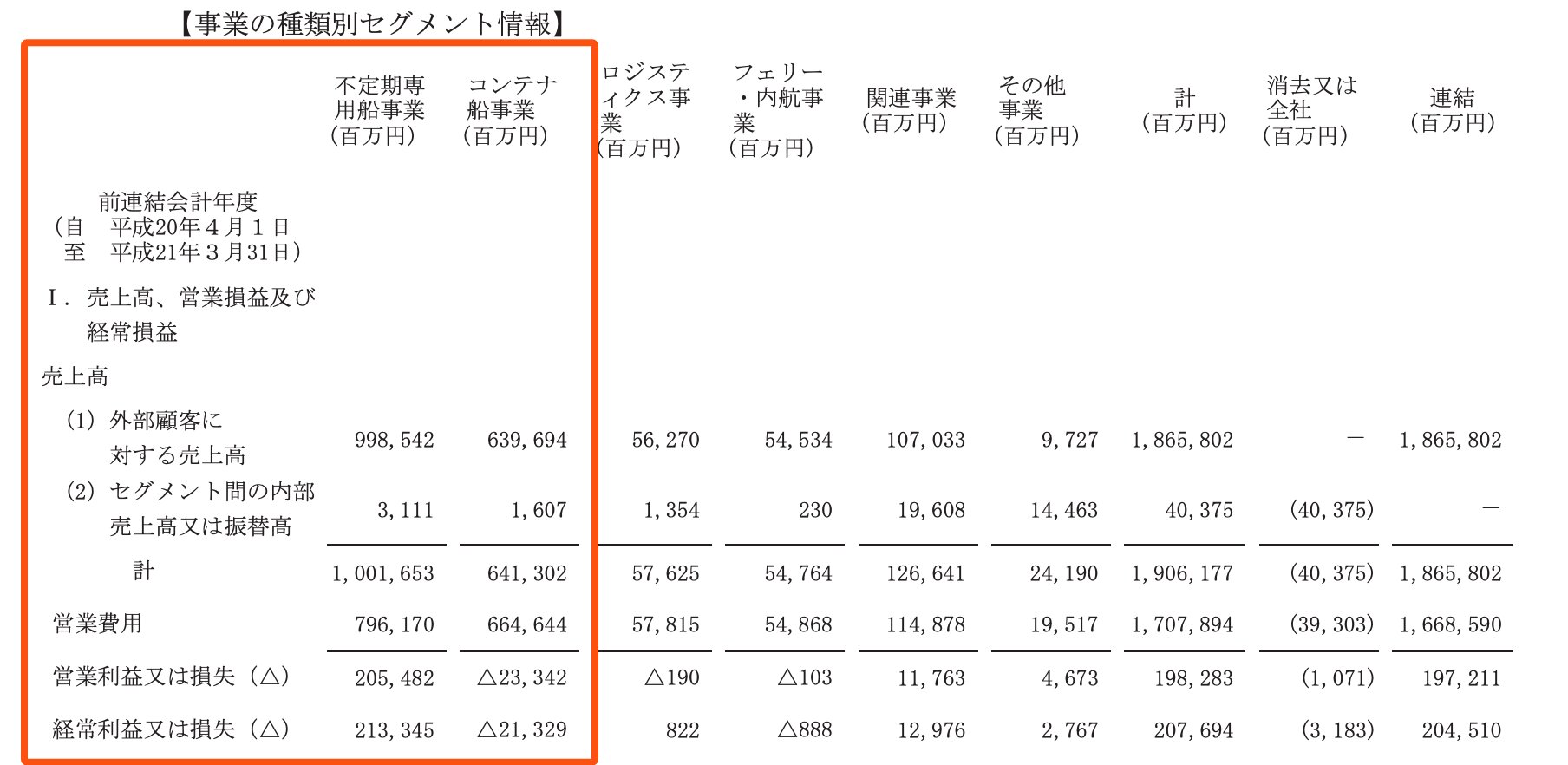

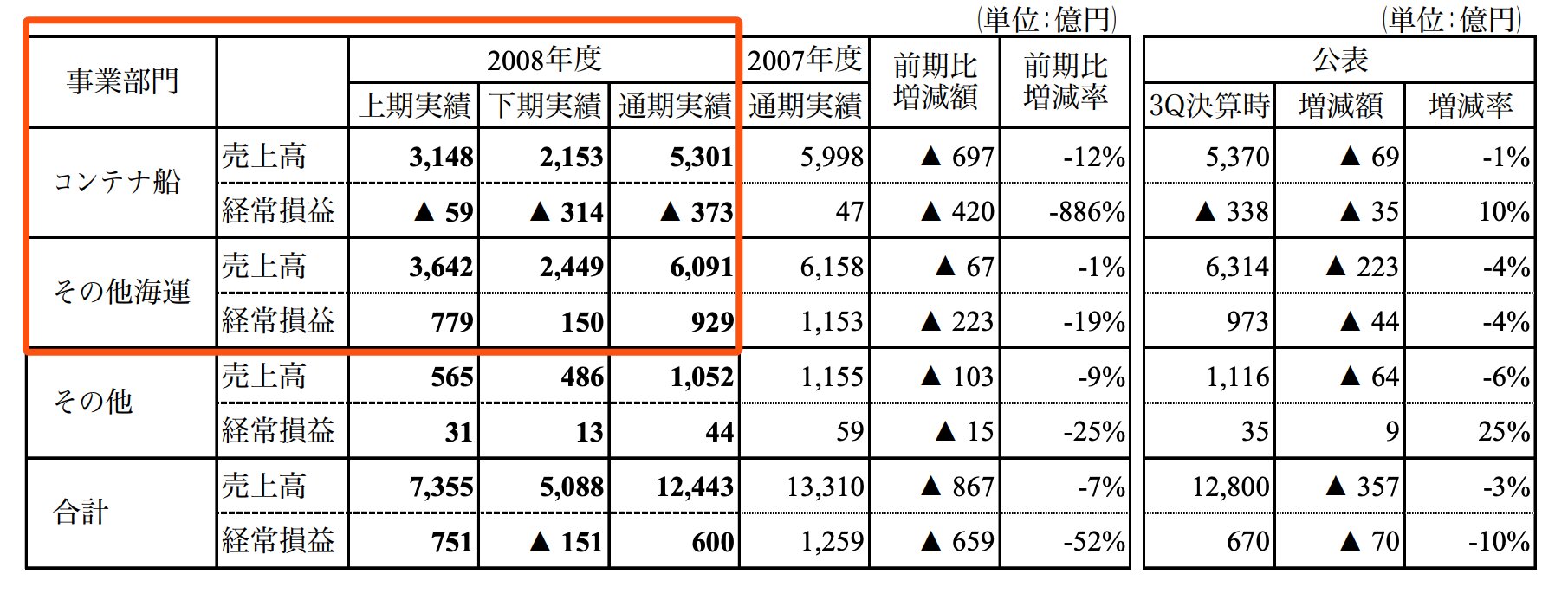

The impact of this is reflected in the financial reports of each of the three Japanese carriers: until 2008, each company had increased sales, and even if they struggled in the containership business, they were able to absorb the losses with profits from the bulk shipping business. However, after the collapse of Lehman Brothers, the container business, which is difficult even for a company to make a profit, continued to lose a large amount of money. The following is an excerpt from each company's financial data for the fiscal year ended March 31, 2009, which shows that the liner trade (container business) is conspicuously in the red.

Comparison of Three Shipping Companies in Japan

▼NYK Financial Report, March 2009

Source:NYK IR library

▼MOL Financial Report, March 2009

Source:MOL IR library

▼Kawasaki Kisen Kaisha, Ltd. Financial Report, March 2009

Source:Kawasaki Kisen Kaisha, Ltd. IR library

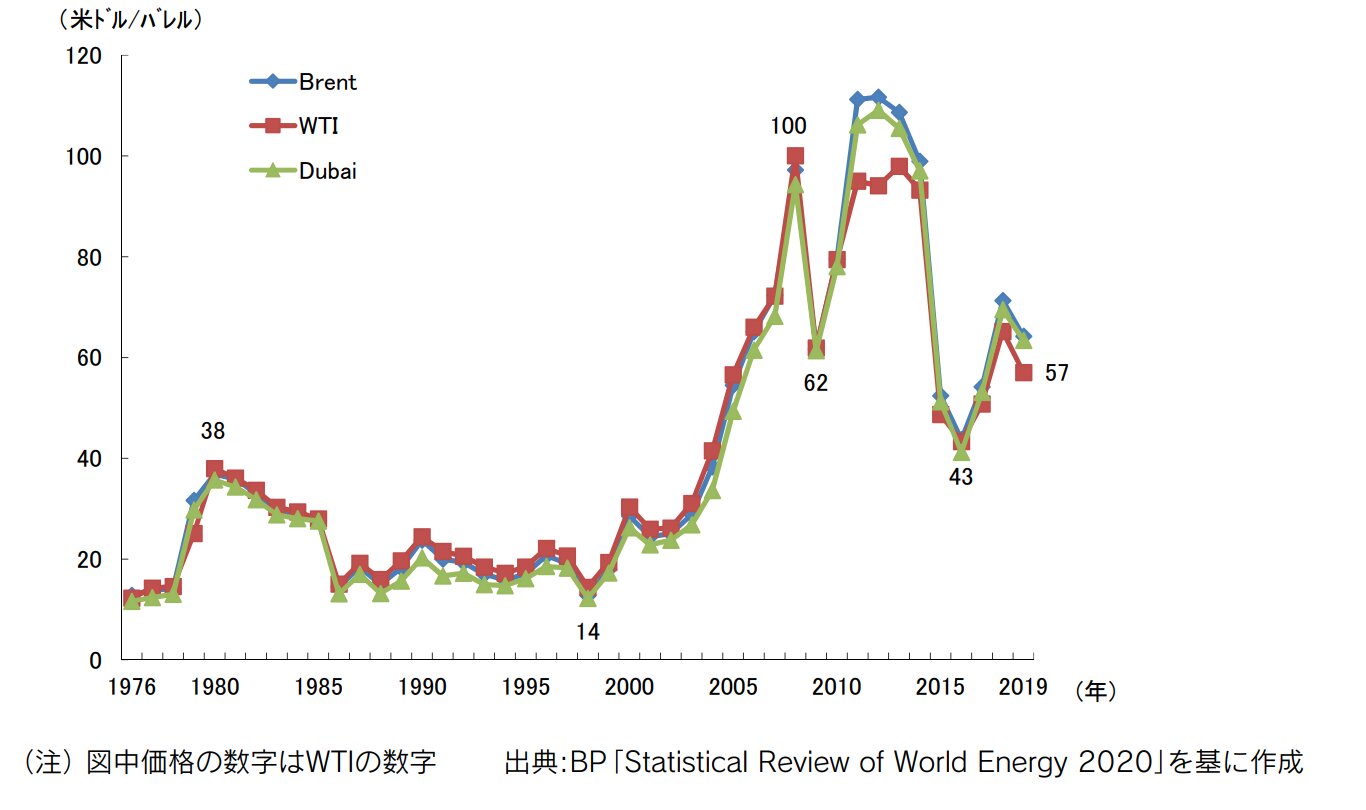

3) Soaring Fuel Prices

Finally, let's look at the trend of international crude oil prices. The graph below shows that the price of crude oil has been soaring steadily since 2001, temporarily dropping due to the Lehman shock but soaring again, and then dropping around 2015 but not returning to the previous level and remaining at a high level. This crude oil price fluctuation is a major risk for the shipping business. Needless to say, the soaring fuel prices put pressure on costs and affect business performance. For example, according to MOL, "We estimate that a $1 per ton increase in the price of bunker oil would have a maximum annual impact of about 190 million yen on our company, including equity method affiliates, in fiscal 2019. *. Since around 2008, in response to this sharp rise in crude oil prices, companies have been adopting energy-efficient navigation by operating at lower speeds.

※source: MOL IR information

▼International Crude Oil Prices

Source:Ministry of Economy, Trade and Industry Annual Report on Energy in FY2020

In the containership business, it is a business model in which economies of scale work very well because it is most economical to operate at low speeds while reducing fuel consumption by increasing the loading ratio to as full as possible with ultra-large containers that can carry approximately 20,000 containers.

Despite this, the number of new orders for container vessels increased during the shipping bubble in the 2000s. The number of container vessels became extremely large. Then, after the collapse of Lehman Brothers, cargo movements declined. The containership business was driven by an oversupply of shipping capacity. If the containership business, which is difficult to turn a profit even just by itself, becomes oversupplied...?

Under these circumstances, alliances in the shipping industry were formed. Alliances in the shipping industry are strategic agreements between container liner shipping companies, aimed at reducing costs and improving efficiency through joint container operations. Kawasaki Kisen Kaisha was a member of CKYH - the Green Alliance, and MOL and NYK were members of the G6 Alliance. At the time, the three companies were not in the same alliance, but in 2016, perhaps feeling a sense of crisis amid repeated mergers and consolidations worldwide, they reorganized their alliances in 2017 and formed THE Alliance, consisting of NYK, MOL, Kawasaki Kisen Kaisha, Hapag-Lloyd (Germany), and Yang Ming Shipping (Taiwan). Alliance was formed by NYK, MOL, Kawasaki Kisen Kaisha, Hapag-Lloyd (Germany), and Yang Ming Shipping (Taiwan). In the same year 2017, the integration of the container shipping business of the three Japanese shipping companies was announced, and ONE was born in April 2018.

Image Source:ONE official site

*All above and referenced sites are current as of 6/7/2022 viewing.

MonCargo tracking service is recommended for container tracking.

Tracking for each shipping company can also be found on their websites. If you only deal with one shipping company, you may want to check these pages.

However, even if you only deal with one carrier, it is time-consuming to check each time to see if the container schedule has changed. Also, you may be asked by other related departments if there has been a change in the ETA schedule. If you are using more than one shipping company, it is even more complicated to manage.

With MonCargo, you will receive email notifications when there is a change in the schedule so you don't miss it. Also, if there are other people in your company tracking the same container, you can share container information with your team, eliminating the need to share information via email or chat.

Want to start tracking containers with MonCargo?

Tracking containers just got easier.

Sign up for MonCargo for free for 30 days from here